Friday was a particularly frustrating day for Jim as he sought to conduct some long overdue business with the eye doctor and orthodontist.

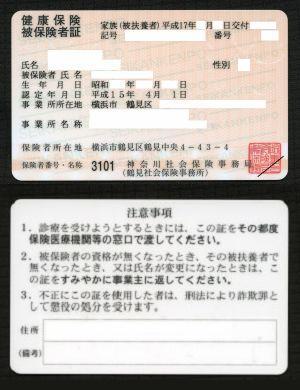

Jim has been carrying COBRA these last several months as he continues shopping around for less costly alternatives.

Those of you with good (and I use that term lightly as the long-term recent trend with employer-provided insurance is for employees to pick up increasing shares of health care tabs while receiving less coverage) employer-provided health insurance will probably not be interested in the rest of this story, but you should.

You never know what kind of curve balls life may throw you—this includes unexpected health care emergencies that may run in the tens of thousands of dollars or more. And unless you are a member of Congress, you will have to pick up some of the tab.

COBRA is an expensive insurance safety net typically available for 18 months once an individual is separated from an employer.

I once used it but as the cost was so prohibitive (you basically are paying the full premium that your employer previously absorbed the bulk of), I ditched it as soon as I found another job with medical insurance benefits.

A friend of mine has never carried health insurance. He has paid for medical, dental and vision services, as he’s needed them. Fortunately for him, he has been a healthy guy throughout his life. This is not the route I would recommend the average person take, however, as you are gambling you will not need an expensive medical procedure that can break you financially.

Are you feeling lucky? Then roll the dice and don’t carry medical insurance. But, feeling lucky or not, it really is a must to have.

…

Jim arrived at the eye doctor for his appointment, filled out some paperwork, returned it to the front desk person and a few minutes later was rejected for coverage for failure to pay his premium.

Problem was, Jim was fully up to date with his premiums, but his COBRA insurer administrator had neglected to pay the separate premium component to his vision insurance provider.

There was nothing the eye doctor office people could do…did Jim want to be seen? Of course he did, but not if he was going to be held financially responsible for the entire visit.

Jim took matters into his own hands, as that was his only choice. He called his COBRA provider and was told it would take a few days to get him in the system for his vision insurance provider to recognize him as benefits-eligible. Understandably, Jim thought this unacceptable. He proceeded to call his vision insurance provider who told him they could not pay for his visit as he is shown as not having coverage (in their system).

Jim asked if the vision insurance person could call the COBRA provider and try to work it out so he could be seen.

The eye doctor was going to try to work him back into the schedule once they received a confirmation number from the vision insurance folks that his visit would be covered.

The vision insurance person asked for the COBRA provider’s customer service number. Jim gave them the number. They put him on hold and began the back and forth, over-the-phone process of straightening out the error in record keeping that was preventing him from seeing the eye doctor.

Jim got off the phone 75 minutes later, his ears red, blood pressure elevated, and was seen by the eye doctor. He spent a total of four hours at the eye doctor’s office that day. The actual doctor visit and exam took 15 minutes.

He barely made it in time to his dental appointment afterwards where, adding insult to injury, he underwent an unexpected root canal.

The good news was that the dentist’s office verified in advance that he was covered insurance-wise.

The bad news was next morning at breakfast–Jim’s crown that was drilled down into for the root canal, came completely off.

His portion for the root canal came in at just under $200, even with dental insurance.

Now he needs a new crown, too, and the dental insurance won’t be paying much if any of the bill, as his annual $1,200 benefit is mostly used up.

Jim’s monthly COBRA premiums are running what he’d pay for a one-bedroom apartment in the town he lives in.

He is having problems finding other insurance, as many insurers still will not provide coverage until a person pays premiums for an extended period, before coverage for pre-existing conditions kicks in.

Before he acted as facilitator between his COBRA and vision insurance providers in order to be seen, Jim met an elderly, retired doctor who was living out the final days of his life with a terminal illness.

He asked the old medical doctor what he did before insurance companies took over the healthcare system.

“I used to make lots of house calls as part of my practice. I treated all kinds of people, delivered babies, you name it—some folks with lots of money, some with no money at all,” said the doctor.

“If they couldn’t pay, I didn’t charge them. My practice was about the relationships I had with my patients. It wasn’t about business.”

Has the process of getting medical care worn you down like Jim and many others? Will pending government involvement help or hinder the levels of bureaucracy and overall quality of treatment received? Is the system irretrievably broken?

And is it too late to take big business out of the equation and get back to compassionate, relationship-based medical care like the dying physician practiced?

Hope not.